Creating A Martian Cryptocurrency

Value Capturing the Red Planet

We are in the midst of a crypto boom, which you are probably tired of. I think that there is one interesting cryptocurrency idea that deserves your attention. Adam Ozimek made the following proposal, and I’d like to flesh this out more:

Creating a cryptocurrency backed by Martian land neatly solves a number of problems at once. Land backing can be good for the currency — it ensures the currency is in controlled or inelastic supply (preventing debasement), while also tied to a potentially actually income generating asset: Martian land. It’s great for Mars — money raised this way can go towards space exploration, which will ultimately make Martian land valuable in the first place. And then, once we colonize Mars, we start off with a nice way to verify and protect property rights, as well as a natural currency to use there.

Historical Land Based Currencies

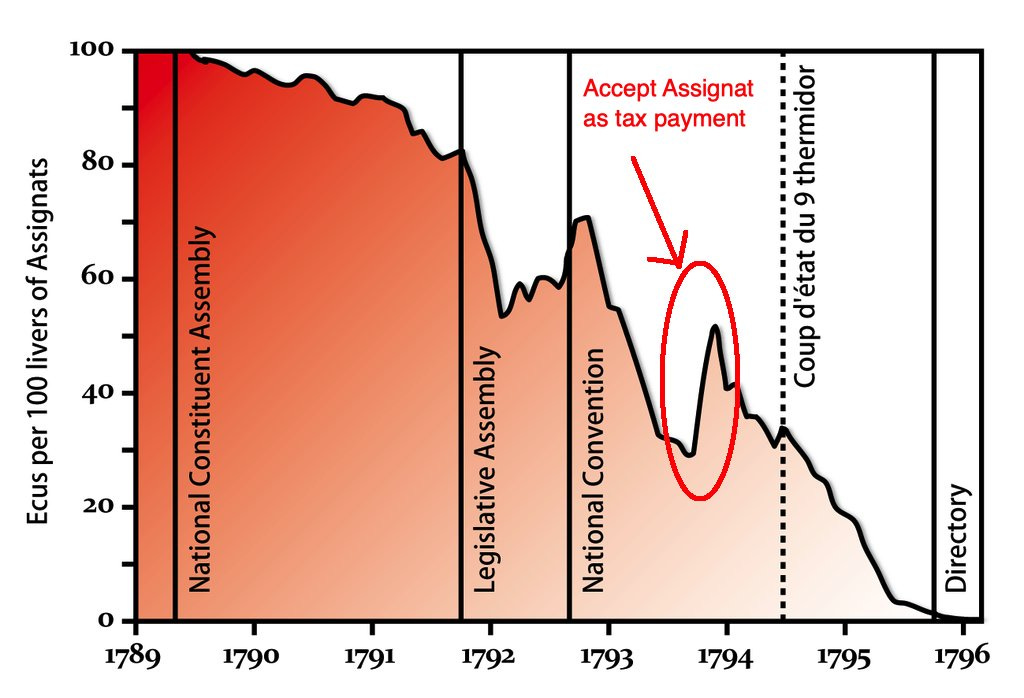

We have a good historical example of a land based currency — the French assignat created during the French Revolution. The sale of Church land served as the base for the currency — see Sargent and Velde.

The history of this currency has an interesting moment in the winter of 1793/94. As the Revolutions podcast describes — to raise revenue, the French revolutionary government demanded forced loans (effectively higher taxes) on the rich; but allowed those payments to be met by (then devalued) assignat. You might think that a situation of dire fiscal straits would be bad for the currency — but the rich wound up soaking up the assignat in circulation and using it for these payments, ultimately raising currency value and lowering inflation.

This episode is nice because it illustrates a classic Adam Smith quote about the ultimately fiscal roots of money:

A prince, who should enact that a certain proportion of his taxes should be paid in a paper money of a certain kind, might thereby give a certain value to this paper money.

A whole fiscal theory of the price level develops that insight further, but you don’t need to go all the way to see that backing a currency on some fundamental value like land, and then tying it as acceptable tax payment for a future Martian sovereign, would be a way of generating value.

Another neat currency experiment comes in the form of Yap stones. These were stone circles used for currency among the residents of Yap island. While smaller stones were exchanged for various goods — this became really interesting once larger stones were used for bigger transactions, but left in place with recognition of the exchange happening orally. People just “knew” that such and such stone belonged to this person. In the extreme — one stone was apparently circulating in exchange even though it sank to the bottom of the ocean in transit. It’s a neat experiment, and highlights the value of money as memory.

Creating a Martian Crypto

Grid System

So the first thing we need to do is set up a Martian grid system. This is valuable to set up a standardized system to recognize property rights. The Manhattan grid, of course, is a great example of a far-sighted system which ensured orderly property development through New York.

We had a nice grid through the American West as well, which led to the development of the American West. Cory Smith has a nice paper on this, which also discusses the role of railroad grants. Railroads were given land in tracts around their railways, which they could sell. The resulting proceeds helped to finance the railroads in the first place, and then the built railroads ensured the land had greater value. This illustrates the basic idea around value capture, which I’m arguing we can apply at the planetary level.

Of course, there was large-scale dispossession of Native Americans here as well. And, more broadly, the notion of land has really tripped up a lot of liberal and libertarian thinkers; ie Locke’s weird concept of it. But Martian land really is starting on a tabula rasa, and we should think constructively about how to manage its ownership.

Creating Private and Public Property

Then, with each gridded property square on Mars, we need to decide what is non-fungible and private; and what is fungible and public.

There are two approaches I can imagine here.

Create separate private and public parcels. In this case, the private property would transact as NFTs — unique property markers, all recorded on Martian deeds records. Each Martian parcel would be unique and grant ownership and development rights on a specific piece of Martian territory.

Separately, there would be public plots owned by some Martian governmental authority. We would ultimately build there, too, but those land rights would remain under the control of the Martian governments. Property tax revenue under public Martian land (like the French assignats) would pay into a common fund; against which Martian public fungible cryptos would be issued. These cryptos are then totally fungible, or identical, and can serve as common currency.

Have basically everything be private; but charge property taxes on all private land. In this case, the public fungible cryptocurrency would be a claim to all Martian property tax revenue. This is the more libertarian option, in case proposal 1 isn’t radical enough for you.

Either way, the end product is one set of private, non-fungible property records recorded in some NFT, where asset ownership is tied with the ownership and use rights of Martian property. And another set of public fungible currencies which are ultimately claims on some cash flow derived from Martian property. The fungible currency would over time become the main currency used on Mars, and could be used to pay Martian taxes.

The Benefits of Martian Crypto

The real goal here is to set up a financial asset whose value depends on our technology to colonize Mars. There are some good reasons that the asset should be structured as an ownership token and currency, which I’ll get to. But the most important thing is that generating Martian-derived assets can generate cash today — which can be plowed directly into space exploration efforts. In turn, more space exploration makes it increasingly likely that all these Martian crypto coins will actually be worth something. So we have a really productive feedback loop of value capture that can boost space exploration.

There are other reasons that some land based currency (on Mars, or elsewhere) works well as a currency. First, to make a currency viable, we generally want some limit on inflating away the currency. Bitcoin achieves this through hard limits on total Bitcoin produced over its lifetime; however there are natural credibility questions about other cryptos whether this will actually happen. Tying currencies to inelastically produced land is another way to address this concern.

At the same time, Bitcoin and other currencies suffer the problem that they are not, well, really claims to anything. In theory, we would like currencies not be just fiat claims that pay out nothing; but actually yield some income themselves. Sovereign currencies also derive currency value from the fact that currencies can be used to pay taxes.

Tying Martian crypto to land and a Martian government addresses these issues too. Ownership of a private Martian NFTs comes with a claim to some Martian land; while the public Martian coins come with claims to some cash flow. Tying everything to the fiscal operations of the future Martian state (states?) is another fundamental anchor of valuation.

Setting up a system for ownership ex ante, before the colonization of Mars, has other benefits for our long-term settlement of the planet. One common feature of NFTs is that every resale of the property kicks back an additional amount to the owner — so speculative transactions of Martian property would generate even more revenue to further Martian development.

These kinds of Tobin taxes have been studied in real estate, for instance by Chun-Che Chi, Cameron LaPoint, and Ming-Jen Lin in Taiwan. You don’t want to go too far in extracting value through a transactions tax here. But speculation on Martian property is likely to happen anyway. Bubbles tend to happen in these situations of radical uncertainty, and trading itself (for still somewhat mysterious reasons) turns out to be important to incorporate the price into the asset value. In normal bubbles, this is all just generally froth with value traded back between people. But with the Martian cryptos, any bubbles in transactions itself serves as a money pump to generate additional funds for Martian colonization — which, again, in turn makes it more likely that those values will get realized.

These crypto tokens are a natural way to set up future property tax levies on Mars; and broadly in setting up property taxes as a main revenue source. As Georgists will tell you — land value taxes are the least disruptive form of taxation, because they don’t incur deadweight loss. Setting up a taxation scheme for Mars ahead of time could involve using token market value as the basis for property taxation. While we are Earthbound, these proceeds would all go again towards Mars colonization. Once there, we could settle and populate the Red Planet with a minimum of economic deadweight loss. Glen Weyl and Anthony Zhang suggest a system of depreciating ownership licenses as another way of implementing taxation with incentives to avoid the hold-up problem — I could see that working too. The main point is to set Mars up for a regime of heavy property taxation to fund essential services, and low taxation of other things.

Henry George, But Mars

In sci-fi, writers usually use the Moon as their canvas for libertarian ideals. This started with Heinlein’s The Moon as a Harsh Mistress; two recent libertarian-influenced novels include Artemis by Andy Weir (you know him better from the book and movie on Mars) and Ian McDonald’s Luna series.

Mars doesn’t have the same libertarian valence for some reason — the Kim Stanley Robinson’s Mars series, for contrast, used Mars as the backdrop for a Communist paradise.

Georgist ideas, for whatever reason, have not flown spaceward as much. But I think we should expand land taxation, both Earthside and beyond, and open our imaginative vision for what new institutional structures as possible in space.

This was a cool example of money in colonial America that is very similar to how MakerDAO manages its stablecoin Dai: https://medium.com/coinmonks/makerdao-18th-century-edition-bd15722d9193