Superblocks

Pedestrianize Cities to Save Them

Cities are great because density adds value for both consumption and production. Workers move to urban areas to tap into larger labor markets, which see greater specialization and clustering due to scale. Proximity also enables urban amenities around dining, shopping, dating, and so forth.

Covid has devastated cities on both of those margins, as both offices and restaurants face the brunt of reduced personal interactions.

This doesn’t mean cities are “dead” or will never recover. But we also can’t ignore that the central value propositions holding together urban areas have been greatly reduced. Cities need to think creatively about ways to continue to attract residents. On the margin, I think this means focusing more on the consumption amenities side—particularly for those that live in central urban areas, rather than commute from further distances.

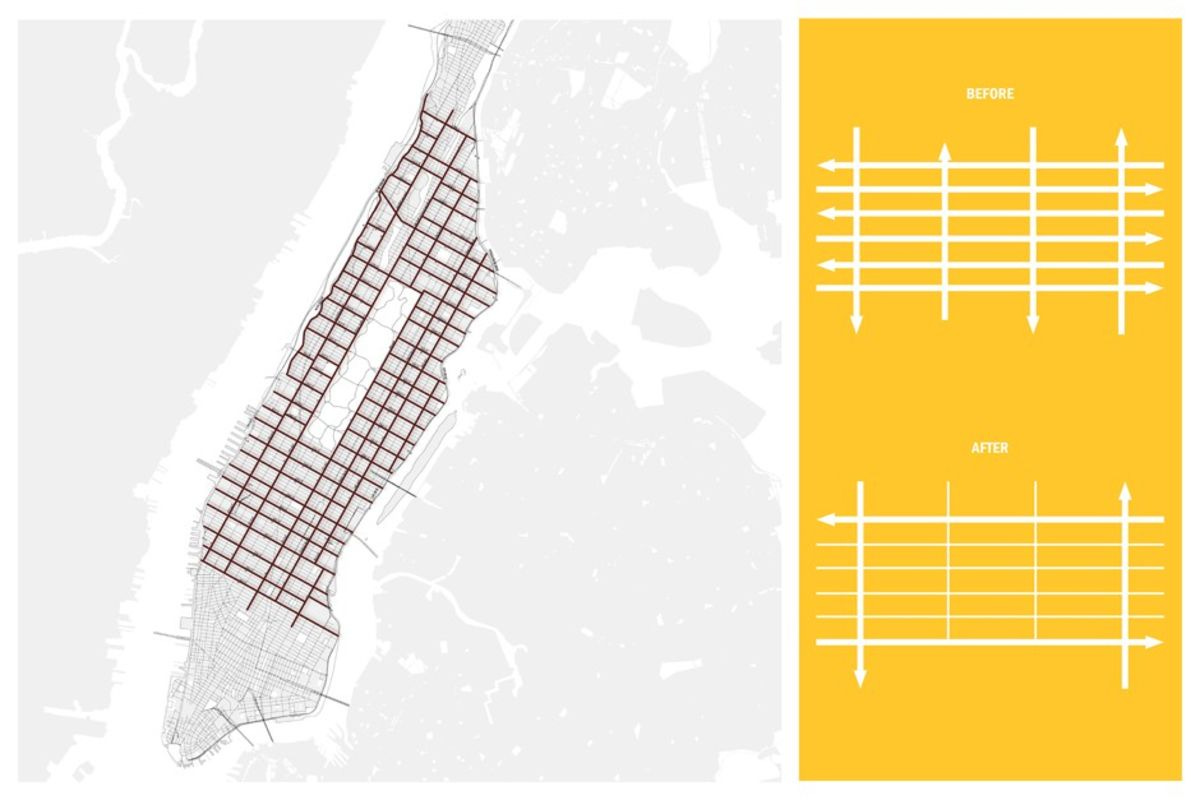

The simplest way to do this is greatly expanding pedestrianization and taking land away from cars—which currently take up something like a fourth of the space in Manhattan, and much more in other dense metros.

Jonathan Cohn and Yunyue Chen have suggested one option—create Superblocks in Manhattan, just like the ones popularized in Barcelona. This would leave arterial roads to ferry cross-town traffic, limiting entry into interior blocks to local cars only at lower speeds. The resulting traffic slowdown can help enable much greater activity—restaurants spilling over onto sidewalks and streets, more bike lanes, more ebikes, more food trucks, trash bins on streets to hold the trash currently filling up sidewalks, etc.

Vishaan Chakrabarti’s PAU plan—referenced in this great Farhad Manjoo piece, would go further towards eliminating private cars from Manhattan entirely.

Just getting rid of cars from cities addresses a lot of livability concerns around cities. Many unpleasant externalities are ultimately related to either cars or all the space they take up—congestion, smells from trash pushed onto the sidewalks, car noise, pollution, and pedestrian deaths (over 200 in NYC in 2019 alone). These are not static characteristics of cities, but instead by-products of our car-centered urban model which systematically deprioritizes pedestrians and ordinary outdoor activity. Plus, Jane Jacobs-style casual public interactions are made much easier through more active public life.

We are seeing the beginnings of these changes as a result of Covid, but it remains far too little. In the Lower East Side, for instance, we have NYC’s first “superblock” that I’m aware of. It’s a wonderful area full of lively activity:

The vibrant streetscape you currently see in the LES, Williamsburg, and other NYC neighborhoods is easily contrasted with the emptiness in Midtown—with primarily serves out-of-towners: commuters and Broadway visitors. This disconnect suggests a natural way for New York to revive—focus on the people who actually live and work here, and make the city an even more enjoyable place to work.

A good example of this shift is the Financial District. Once a dense office center, the area saw steady declines in office space after 9/11. Instead, the area saw huge growth in residential office space. Given the dense warren of streets, further restricting car access—and doubling down on public life in the streets—would make the area even more livable. Converting office towers in Midtown to residential, and getting rid of the bumper-to-bumper traffic would make Midtown actually pleasant. You can see this already in Midtown—those blocks that have pedestrianized are noticeably nicer and have more street traffic. We can just do this all over NYC and other cities.

Summer School

I’ve been really impressed with the virtual and other educational lecture content that’s been released over this pandemic. Here are a few of my favorites:

Francesco Trebbi’s political economy notes. I particularly enjoyed the discussion of this great Snyder and Snowberg paper.

Data wrangling videos by Nick Huntington-Klein.

Grant McDermott has a cool data science for economists course.

How to do structural estimation by Tyler Ransom.

How to do OBS, the hip new way to get your face combined with background material such as slides, by Luke Stein.

Macro Finance Society lectures. Itamar Drechsler’s session is particularly interesting. He points out that we don’t really know how monetary policy actually works, and discusses some of his work (with Philipp Schnabl and Alexi Savov) that highlights a bank deposit channel.

Great series on Urban Economics. I really enjoyed a number of these—the ones by Leah Boustan and Dave Donaldson have been two of my favorites so far.

K-Recovery in Housing Markets

This was a good week for housing data. Purchase applications are up month-to-month, and now down just 10% cumulatively over the year. Home sales are also booming, but have yet to make up the loss. At the same time, 7.5% of homeowners were in forbearance in early August; Census Pulse surveys suggest that about a third of renters don’t expect to make their August rent payment; and Datex suggests that landlords are not collecting 27% of rents. However, evictions are down—even in jurisdictions that don’t have formal forbearance plans (just as personal bankruptcies are down, as Jialan Wang and co-authors have found). What exactly is happening?

I think the right way to think about it is that a lot of households and firms are using an implicit insurance option offered in their contracts—the option to delay payment. Even in the absence of formal legal forbearance, a common implicit norm is that temporary non-payment will not automatically trigger eviction/foreclosure.

Under high uncertainty, neither side is really willing to walk away yet. Households and firms are delinquent on rents and mortgages, but unwilling to stop payments all the way to eviction, foreclosure, or bankruptcy—or fail as a retail firm. Firms are seeing lack of payments, but are also unwilling to evict/foreclose either.

I think the future here depends completely on the scope of future fiscal and monetary interventions and the pace that economic activity resumes. Right now renters facing bills are deciding “do I want to pay this month; or wait and see what happens next month.” Eventually they will decide “do I want to pay at all or walk away.”

College Reopening Watch

This was a big week for Colleges and University reopening. UNC was the standout case here, as they refused to test on entry despite a faculty petition (the usual testing-gives-you-false-confidence story). Other non-mass testing schools like Ithaca College, MSU, and NC State also went virtual, either forced to because of Covid clusters or preemptively.

But even test-on-arrival schools are seeing problems. Notre Dame is going virtual for two weeks, and Alabama is apparently seeing rising test positivity rates. Their home states, notably, still have continuing pandemics.

I expect many schools around the country will follow. In my home state of NC; you see apparent clusters at Appalachian State and ECU for instance that are likely to grow further.

That leaves two sets of Universities for which the status of this Fall remains an open question:

Schools plan to test everyone regularly: Illinois, for instance, did as much as 1% of all testing nationwide on entry. It appears they caught a few hundred cases on entry, who will now be quarantined. Regular saliva tests from here on out are intended to prevent any cases that students subsequently get from parties/bars/etc. from turning into community spread. Many other schools—Yale, UChicago, UCSD, Cornell, BU, many Northeast schools helped by the Broad Institute—have similar plans. My expectation is that this will work, but we’ll see.

Schools that test once, but are in lower prevalence regions: This includes schools like Dartmouth and other parts of the Northeast. The hope is that testing/quarantining students on entry will limit any outside cases, and future spread will be limited by the relative lack of community spread in the area. I’m more skeptical this will work out, but who knows.

The central problem here is we have large swaths of the country that are unable or unwilling to invest in a surveillance testing infrastructure, and so are choosing a Sweden + mask policy instead. But neither do they have the appetite to tolerate cases among students. So we have these fits and starts of reopening that ultimately cause way more harm.

Wasn’t the econ blogosphere fun? Let’s bring that back. Twitter is okay but having some space to develop some ideas is nice.